AMP – The new industry currency for published media

AMP is the new joint industry currency for published media, using world leading methodology. It produces de-duplicated brand reach, allowing users to carry out reach & frequency planning to better commercialise audiences across all platforms and help drive growth across the industry.

1. What is PAMCo?

The Publishers Audience Measurement Company (PAMCo), is the governing body which oversees audience measurement for the published media industry. Our funding stakeholders are News Media Association (NMA – representing Newsbrands), Professional Publishers Association (PPA – Magazine Media) and the Institute of Practitioners in Advertising (IPA – Advertising Agencies). Our board also has representation from The Incorporated Society of British Advertisers (ISBA), and a research specialist, currently our research partner, Ipsos MORI.

2. What is AMP?

Audience Measurement for Publishers (AMP), is the new audience measurement service, which will supersede NRS.

AMP data can be used to market the published media sector, demonstrating high levels of brand reach across platforms. It will allow publishers to monetise de-duplicated audiences across all their platforms – mobile, tablet, pc and print.

AMP will be incorporated into the computer bureaux such as Telmar, Kantar, IMS and Mediatel, as well as the IPA Touchpoints service for planning purposes.

3. Why is AMP better than NRS?

NRS was a print survey which had digital elements added to it across its existence. The thorough industry wide process to find the successor to NRS, has allowed us to design audience measurement built for a digital world. This is reflected in a world leading methodology, with our own digital panel passively measuring behaviour, coupled with the rigour of 35,000 face to face interviews, offering the best of the tried and trusted and new digital innovation. This will allow the AMP survey to provide the following:

- De-duplicated reach and frequency for all platforms

- Single source data to understand how audiences move between platforms

- Improved estimate of net brand reach and duplication

- Reporting newsbrand sections across print AND digital (subject to sample size)

- Future proofed for new platforms

- Increased number of brands reported across digital platforms

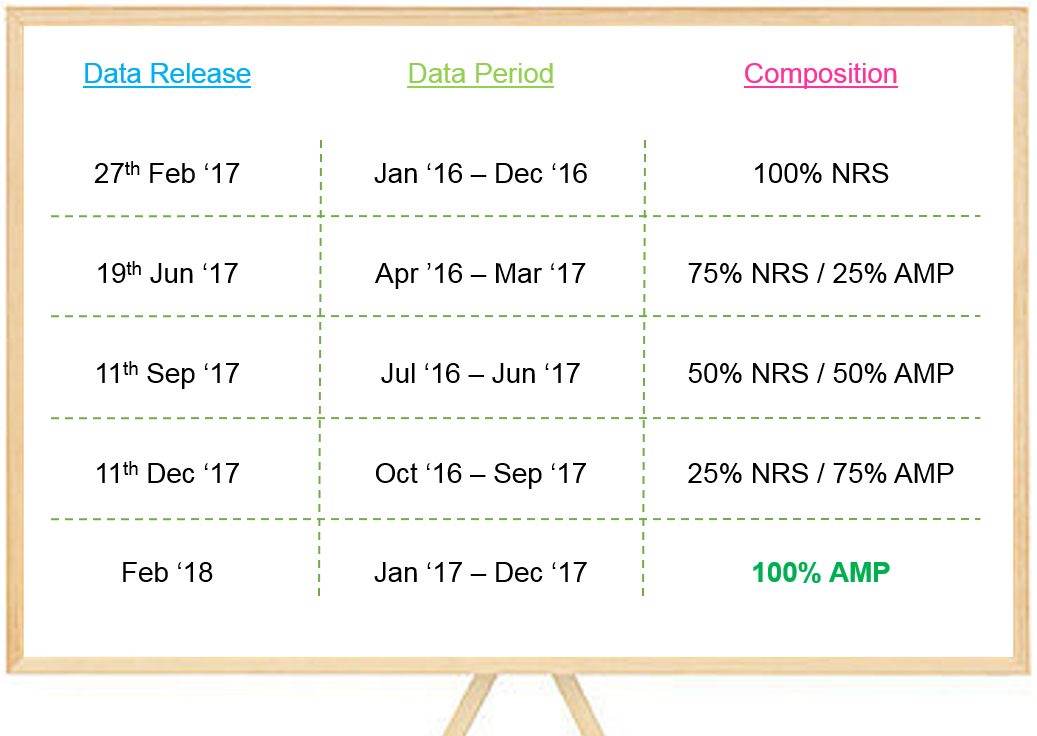

- When will AMP data be in the market?

- The first 100% AMP dataset with full utility will be the January – December 2017 dataset and this will be published in February 2018.

4. What has happened to NRS?

NRS Ltd has handed responsibility for governance to PAMCo Ltd, from January 2016. NRS data will continue to be published throughout 2017 but from Quarter 1 2017 the print data will be a blend of AMP and NRS print data (for more detail please refer to point 6 below).

5. What is happening in 2017?

In 2017, the print data will be blended from NRS and AMP samples, and the NRS PADD style fusion will still be used to deliver digital audience estimates. NRS/AMP blended data will be published at the Quarter 1, 2 and 3 2017 data releases, with an incremental proportion of AMP data until the first 100% AMP dataset for January – December 2017, which will be published in February 2018.

How it all works

1. How is AMP data collected?

AMP data is collected from three main sources:

- A high-quality enumeration/readership survey of 35,000 participants per year interviewed in home.

- A digital panel of 5,000 participants per annum (recruited from the survey participants at the time of interview) to have a specially designed Tracker App installed on their devices i.e. pcs, laptops, mobile, tablet. The principal purpose of this panel is to provide single source data on duplication between reading in print and reading on digital platforms. It is not the intention to report digital platform estimates directly from the panel.

- Estimates of the audiences for digital platforms will be sourced directly from comScore, and this data will be fused with the enumeration/readership survey. Duplication of reading between the print and digital platforms will be adjusted to match observations from AMP’s own panel.

2. What is different about AMP?

There are differences in both the methodology and the utility of the AMP data.

The key methodological differences are that AMP has a brand first readership interview (whereas NRS was print first) which is a first for the industry and the introduction of the digital panel in order to provide single-source data on duplication for the first time. Other important differences within the interview include:

- AMP uses full colour masthead prompts for the readership questions, including non- date specific front covers for the magazines and newspaper supplements

- Questions about print newsbrands ask specifically about weekday and Saturday papers, rather than the ‘6-day’ approach used by NRS

- There are changes to the scale used to establish frequency of reading

- AMP interview is carried out on a single tablet screen rather than Double Screen CAPI

In terms of utility, AMP will publish audience estimates for many more digital platforms than NRS, and reach and frequency planning will be possible across all platforms (for NRS this was only possible for pc platforms).

All platforms will have the facility for the following:

- Reporting of daily, weekly and monthly reach (subject to sample size)

- The facility for reach and frequency planning individually or in combination with other platforms.

3. Why is PAMCo incorporating comScore’s digital estimates?

The reasons why PAMCo will incorporate comScore’s estimates for digital platforms, rather than issue its own estimates, are as follows:

- Published media wish to have a level playing with all other digital brands in the universe. Buyers have told PAMCo this is critical to enable like for like comparisons and it would be unhelpful for PAMCo to release a different and conflicting set of numbers to comScore/ UKOM, which is the de facto currency.

- With a sample of 5,000, the panel is too small to provide direct measures for more than a small number of brands. Its purpose is instead to provide a high-quality source of data on print and digital duplication, to enable net reach to be calculated more effectively than has been possible in the past.

4. Which platforms are reported?

- Mobile phone

- Tablet

- PC website

5. Will AMP include estimates for new emerging platforms such as Apple News and Facebook Instant Articles?

This will be a decision for the PAMCo Board and also depends on whether comScore is able to deliver estimates for the platforms concerned and how big those audiences are. PAMCo will monitor the situation on an on-going basis, as it is likely to change quickly.

comScore is at a different stage of development in measuring each platform concerned. For example, comScore are still developing their measurement system for Apple News, and it would not be possible to incorporate estimates at the present time, though the practicalities are likely to have changed by the time the AMP digital data are launched. On the other hand, comScore do have a system in place to measure Facebook Instant Articles, but this requires special action from publishers in conjunction with comScore. Even when comScore can provide estimates, the PAMCo Board will need to decide if and how they can be added to the AMP database in a transparent and fair manner.

6. Will more brands be covered?

Yes, AMP will deliver a similar number of print titles but an increased number of brands across digital platforms. All publisher owned digital brands will be covered which is over and above what NRS covers.

7. Will the audience numbers be comparable?

No, the audience estimates will not be directly comparable with NRS. There are many changes which mean that it will not be possible to make direct comparisons for commercial purposes, and the AMP data are in effect a brand new dataset. For instance, changes to the readership questions include the introduction of a ‘brand-first’ questionnaire structure.

Although the audience estimates for digital platforms will be sourced from comScore, as they were for NRS PADD, overall estimates of brand reach are likely to change as estimates of the duplication of reading in print and digital will be derived from AMP’s new panel.

Due to the different methodologies, the PAMCo Board have mandated that NRS and AMP data should not be compared for commercial or marketing purposes. This means that from Q1 2017 data release onwards the data should not be compared with previous periods of NRS data. Also, individual periods should not be broken out to compare NRS and AMP data for commercial or marketing purposes.

New AMP questions and increased utility such as de-duplicated reach & frequency for all platforms will be available with the first full AMP data release in February 2018.

8. How does AMP compare to other systems around the world?

No other country as yet has a cross-device digital panel run in conjunction with the readership survey, so there is great interest in this particular development in Great Britain. There is growing interest around the world in how to better integrate estimates of digital reading, particularly with respect to understanding and reflecting duplication of readership between platforms, including work in Switzerland and France.

There is also a trend to new measurement systems adopting a ‘brand-first’ approach, which AMP will also adopt. Where AMP differs is in the continued investment in face-to-face interviewing rather than using online interviewing for part or the entire sample, which the majority of other new measurement systems do. Overall the majority of existing readership surveys around the world employ a face-to-face approach, as AMP will do.

Accessing & using the data

1. How will I access the data?

The top line data will be posted on the AMP website and are available without subscription. PAMCo subscribers have access to the full AMP database via one of the computer bureaux (Telmar, IMS, Kantar, Mediatel) licensed by PAMCo Ltd to provide a data analysis service.

2. Who can be measured on AMP?

Any print or digital publication carrying display advertising is welcome to apply to have their title measured.

Publications which are not normally covered include:

- Regional titles (other than the Scottish newsbrands)

- Titles carrying only classified advertising, or not carrying advertising at all

- Trade, business or professional titles, or special-interest titles whose readers are unlikely to be properly represented in the sample

- Titles aimed primarily at children (aged 14 or less)

- Titles appearing less often than quarterly, or titles which appear irregularly

3. How do I get my brand on AMP?

Publishers who are members of either the NMA or the PPA and who wish to have their brand/s covered by the survey should in the first instance approach the relevant association.

4. How do titles qualify to have estimates published?

The required sample sizes differ by platform and the current criteria are under discussion by the PAMCo Technical Committee. Once the PAMCo Board has approved, these criteria will be issued.

5. How frequently are results published?

The results will be published on a quarterly basis

6. How can I get trained on AMP?

Please contact Daphna Joseph on Daphna@pamco.co.uk